Email Richard Cordray

Send a resounding message to the CFPB and Director Richard Cordray: Stop the debt trap.

#StopTheDebtTrap Selfie

Create your own #StopTheDebtTrap selfie to help spread the word with these simple steps.

Sign up for updates

Get informed on how you can help stop the debt trap from returning to North Carolina.

For 15 years, N.C. legislators, regulators and advocates have spent massive blood, sweat and tears to force high-cost lending out of our state and keep it out.

We've seen the harm first-hand: During the four years that payday lending was legal and the six more years that these shady lenders continued to make loans illegally in our state, we saw the tremendous damage caused by these triple-digit loans and how hard it was for North Carolina families to escape the debt trap.

No one wants them back — except the high-cost lenders, who appear to have endless resources to push their payday agenda.

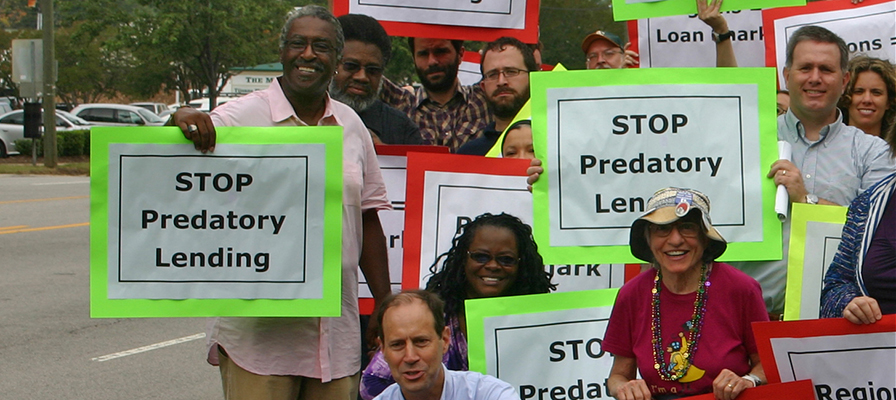

There is strong and long standing opposition in North Carolina to payday and other high-cost lending. Join the fight to keep payday lending illegal here and to prevent the rules from being weakened in other states. Let's work together to #StopTheDebtTrap.

Learn more and get involved: 1-800-747-3207

Sign up for Updates

FAQs

-

Is Payday Lending Legal in North Carolina?

North Carolina is one of several states that wisely prohibit payday lending. Our state banned payday lending in 2001.

Payday loans charge high annual percentage interest rates (APR), often of 400 percent or more. The loans have short terms, making it hard for borrowers to pay them off in time; as a result, borrowers are “flipped” from one loan to the next. These loans trap consumers in long-term, high-cost debt while lenders make millions in profits.

Payday lenders are big national corporations that often target low-wealth consumers, including military personnel, minorities, and families living paycheck to paycheck. It is estimated that North Carolina families save hundreds of millions of dollars every year because these loans are illegal here.

-

Is There a Push To Legalize Payday Lending Here?

Yes. Each legislative session, wealthy and powerful interests try to bring payday lending back to North Carolina.

Current law allows small loan interest rates of up to 30 percent – plus fees that make the loans even more expensive. But the payday lenders have repeatedly attempted to pass bills that would allow lenders to charge an annual percentage rate well above 300 percent. This would be devastating for North Carolina families, who would once again face risks of the debt trap.

-

How Does the Public Feel About Payday Lending?

For 15 years, North Carolinians have actively opposed allowing payday lenders back into our state. A March 2015 poll conducted by Public Opinion Strategies showed that North Carolinians remain strongly united in their opposition to payday lending. In extremely strong poll results, 83 percent of registered voters oppose state legislation that would allow payday lending in North Carolina, with 66 percent strongly opposing. These polling results were consistent across party lines and ideology (from very conservative to very liberal).

-

What Harm Would Bringing Payday Lending Back to NC Cause?

Payday lending would trap consumers in debt while enriching lenders. Low-wealth borrowers, borrowers of color and service members would be especially affected since they are targets for these high-cost loans. We estimated that North Carolina families living paycheck to paycheck have saved $153 million every year since 2006 because these loans are illegal here.

Media Coverage, Links and Resources

In the news

- “The Dangers of Allowing Debt-Trap Lending in NC,” News & Observer.

- “How Payday Lenders Prey Upon the Poor,” New York Times.

- “Dangers of the Payday Loan Legalization Bill,” News & Views from NC Policy Watch.

- “Our View: Don’t Let Payday Lenders Back in NC,” Lincoln Times-News.

- “Payday Lending Bill Draws Criticism,” WRAL.

North Carolina Resources

- Keep Payday Lenders Out of NC: Weak National Payday Rule Would Be Serious Threat to NC Consumer (PDF download)

- Why We Must Keep Payday Lenders Out of NC: North Carolinians Caught in the Debt Trap (PDF download)

- Sign-up Sheet (hardcopy for meetings): Keep Payday Lenders Out of NC: Join the Fight for a Strong National Payday Rule (PDF download)